-

Altomare hangs on to tie defending champ Korda at LPGA Match Play

Altomare hangs on to tie defending champ Korda at LPGA Match Play

-

Paraguay gold rush leaves tea producers bitter

-

Health concerns swirl as Bolivian city drowns in rubbish

Health concerns swirl as Bolivian city drowns in rubbish

-

Syria says deadly Israeli strikes a 'blatant violation'

-

Financial markets tumble after Trump tariff announcement

Financial markets tumble after Trump tariff announcement

-

Starbucks faces new hot spill lawsuits weeks after $50mn ruling

-

Europe riled, but plans cool-headed response to Trump's tariffs

Europe riled, but plans cool-headed response to Trump's tariffs

-

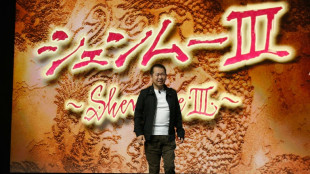

'Shenmue' voted most influential video game ever in UK poll

-

New coal capacity hit 20-year low in 2024: report

New coal capacity hit 20-year low in 2024: report

-

Revealed: Why monkeys are better at yodelling than humans

-

Key details on Trump's market-shaking tariffs

Key details on Trump's market-shaking tariffs

-

'A little tough love': Top quotes from Trump tariff talk

-

US business groups voice dismay at Trump's new tariffs

US business groups voice dismay at Trump's new tariffs

-

Grealish dedicates Man City goal to late brother

-

US tariffs take aim everywhere, including uninhabited islands

US tariffs take aim everywhere, including uninhabited islands

-

Trump sparks trade war with sweeping global tariffs

-

Israeli strikes hit Damascus, central Syria; monitor says 4 dead

Israeli strikes hit Damascus, central Syria; monitor says 4 dead

-

Slot 'hates' offside rule that gave Liverpool win over Everton

-

US stocks end up, but volatility ahead after latest Trump tariffs

US stocks end up, but volatility ahead after latest Trump tariffs

-

Barca oust Atletico to set up Clasico Copa del Rey final

-

Mourinho grabs Galatasaray coach's face after losing Istanbul derby

Mourinho grabs Galatasaray coach's face after losing Istanbul derby

-

Grealish strikes early as Man City move up to fourth in Premier League

-

Reims edge out fourth-tier Cannes to set up PSG French Cup final

Reims edge out fourth-tier Cannes to set up PSG French Cup final

-

Liverpool beat Everton as title looms, Man City win without Haaland

-

Jota wins bad-tempered derby as Liverpool move 12 points clear

Jota wins bad-tempered derby as Liverpool move 12 points clear

-

Inter and Milan level in derby Italian Cup semi

-

Stuttgart beat Leipzig to reach German Cup final

Stuttgart beat Leipzig to reach German Cup final

-

Trump unveils sweeping global tariffs

-

Italian director Nanni Moretti in hospital after heart attack: media

Italian director Nanni Moretti in hospital after heart attack: media

-

LIV Golf stars playing at Doral with Masters on their minds

-

Trump unveils sweeping 'Liberation Day' tariffs

Trump unveils sweeping 'Liberation Day' tariffs

-

Most deadly 2024 hurricane names retired from use: UN agency

-

Boeing chief reports progress to Senate panel after 'serious missteps'

Boeing chief reports progress to Senate panel after 'serious missteps'

-

Is Musk's political career descending to Earth?

-

On Mexico-US border, Trump's 'Liberation Day' brings fears for future

On Mexico-US border, Trump's 'Liberation Day' brings fears for future

-

Starbucks faces new hot spill lawsuit weeks after $50mn ruling

-

Ally of Pope Francis elected France's top bishop

Ally of Pope Francis elected France's top bishop

-

'Determined' Buttler leads Gujarat to IPL win over Bengaluru

-

US judge dismisses corruption case against New York mayor

US judge dismisses corruption case against New York mayor

-

Left-wing party pulls ahead in Greenland municipal elections

-

Blistering Buttler leads Gujarat to IPL win over Bengaluru

Blistering Buttler leads Gujarat to IPL win over Bengaluru

-

Tesla sales slump as pressure piles on Musk

-

Amazon makes last-minute bid for TikTok: report

Amazon makes last-minute bid for TikTok: report

-

Canada Conservative leader warns Trump could break future trade deal

-

British band Muse cancels planned Istanbul gig

British band Muse cancels planned Istanbul gig

-

'I'll be back' vows Haaland after injury blow

-

Trump to unveil 'Liberation Day' tariffs as world braces

Trump to unveil 'Liberation Day' tariffs as world braces

-

New coach Edwards adamant England can win women's cricket World Cup

-

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

Military confrontation 'almost inevitable' if Iran nuclear talks fail: French FM

-

US stocks advance ahead of looming Trump tariffs

Greenlane Holdings, Inc. Announces $25.0 Million Private Placement Priced at the Market Under Nasdaq Rules

BOCA RATON, FL / ACCESS Newswire / February 18, 2025 / Greenlane Holdings, Inc. (NASDAQ:GNLN) (the "Company"), one of the premier global sellers of premium cannabis accessories, child-resistant packaging, and specialty vaporization products, today announced that it has entered into definitive agreements with institutional investors for the purchase and sale of approximately $25.0 million of shares of Common Stock and investor warrants at a price of $1.19 per Common Unit. The entire transaction has been priced at the market under Nasdaq rules.

The offering consisted of the sale of Common Units (or Pre-Funded Units), each consisting of (i) one (1) share of Common Stock or one (1) Pre-Funded Warrant, (ii) one (1) Series A PIPE Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $1.4875 ("Series A Warrant") and (iii) one (1) Series B PIPE Common Warrant to purchase one (1) share of Common Stock per warrant at an exercise price of $2.975 ("Series B Warrant" and together with the Series A Warrant, the "Warrants"). The offering price per Common Unit is $1.19. The initial exercise price of each Series A Warrant is $1.4875 per share of Common Stock. The Series A Warrants are exercisable following stockholder approval and expire five (5) years thereafter. The number of securities issuable under the Series A Warrant is subject to adjustment as described in more detail in the report on Form 8-K to be filed in connection with the offering. The initial exercise price of each Series B Warrant is $2.975 per share of Common Stock or pursuant to an alternative cashless exercise option. The Series B Warrants are exercisable following stockholder approval and expire two and one-half (2.5) years thereafter. The number of securities issuable under the Series B Warrant is subject to adjustment as described in more detail in the report on Form 8-K to be filed in connection with the offering.

Aggregate gross proceeds to the Company are expected to be approximately $25.0 million. The transaction is expected to close on or about February 19, 2025, subject to the satisfaction of customary closing conditions. The Company expects to use the net proceeds from the offering, together with its existing cash, for the repayment of existing indebtedness, general corporate purposes and working capital.

Aegis Capital Corp. is acting as exclusive placement agent for the private placement. Sichenzia Ross Ference Carmel LLP is acting as counsel to the Company. Kaufman & Canoles, P.C. is acting as counsel to Aegis Capital Corp.

The securities described above are being sold in a private placement transaction not involving a public offering and have not been registered under the Securities Act of 1933, as amended (the "Securities Act"), or applicable state securities laws. Accordingly, the securities may not be reoffered or resold in the United States except pursuant to an effective registration statement or an applicable exemption from the registration requirements of the Securities Act and such applicable state securities laws. The securities were offered only to accredited investors. Pursuant to a registration rights agreement with the investors, the Company has agreed to file one or more registration statements with the SEC covering the resale of the Common Stock and the Shares issuable upon exercise of the Pre-Funded Warrants and Warrants.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Greenlane Holdings, Inc.

Founded in 2005, Greenlane is a premier global platform for the development and distribution of premium smoking accessories, vape devices, and lifestyle products to thousands of producers, processors, specialty retailers, smoke shops, convenience stores, and retail consumers. We operate as a powerful family of brands, third-party brand accelerator, and an omnichannel distribution platform.

We proudly offer our own diverse brand portfolio and our licensed Marley Natural and K. Haring branded products. We also offer a carefully curated set of third-party products through our direct sales channels and our proprietary, owned and operated e-commerce platforms which include Vapor.com, PuffItUp.com, HigherStandards.com, Wholesale.Greenlane.com and MarleyNaturalShop.com.

For additional information, please visit: https://investor.gnln.com. https://gnln.com/.

Forward-Looking Statements

The foregoing material may contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, each as amended. Forward-looking statements include all statements that do not relate solely to historical or current facts, including without limitation statements regarding the Company's product development and business prospects, and can be identified by the use of words such as "may," "will," "expect," "project," "estimate," "anticipate," "plan," "believe," "potential," "should," "continue" or the negative versions of those words or other comparable words. Forward-looking statements are not guarantees of future actions or performance. These forward-looking statements are based on information currently available to the Company and its current plans or expectations and are subject to a number of risks and uncertainties that could significantly affect current plans. Should one or more of these risks or uncertainties materialize, or the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, performance, or achievements. Except as required by applicable law, including the security laws of the United States, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results.

Investor Contact:

[email protected]

or

TraDigital IR

Kevin McGrath

+1-646-418-7002

[email protected]

SOURCE: Greenlane Holdings, Inc.

View the original press release on ACCESS Newswire

A.Mahlangu--AMWN