-

Exec linked to Bangkok building collapse arrested

Exec linked to Bangkok building collapse arrested

-

Zelensky says Russian attacks ongoing despite Putin's Easter truce

-

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

Vaibhav Suryavanshi: the 14-year-old whose IPL dream came true

-

Six drowning deaths as huge waves hit Australian coast

-

Ukrainian soldiers' lovers kept waiting as war drags on

Ukrainian soldiers' lovers kept waiting as war drags on

-

T'Wolves dominate Lakers, Nuggets edge Clippers as NBA playoffs start

-

Taxes on super rich and tech giants stall under Trump

Taxes on super rich and tech giants stall under Trump

-

Star Wars series 'Andor' back for final season

-

Neighbours improvise first aid for wounded in besieged Sudan city

Neighbours improvise first aid for wounded in besieged Sudan city

-

Tariffs could lift Boeing and Airbus plane prices even higher

-

Analysts warn US could be handing chip market to China

Analysts warn US could be handing chip market to China

-

Unbeaten Miami edge Columbus in front of big MLS crowd in Cleveland

-

Social media helps fuel growing 'sex tourism' in Japan

Social media helps fuel growing 'sex tourism' in Japan

-

'Pandora's box': alarm bells in Indonesia over rising military role

-

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

Alaalatoa hails 'hustling hard' Brumbies for rare Super Rugby clean sheet

-

Trio share lead at tight LA Championship

-

Sampdoria fighting relegation disaster as old heroes ride into town

Sampdoria fighting relegation disaster as old heroes ride into town

-

Recovering pope expected to delight crowds at Easter Sunday mass

-

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

Nuggets edge Clippers in NBA playoff overtime thriller, Knicks and Pacers win

-

Force skipper clueless about extra-time rules in pulsating Super Rugby draw

-

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

Nuggets edge Clippers in NBA playoff overtime thriller, Pacers thump Bucks

-

Unbeaten Miami edge Columbus in front of big crowd in Cleveland

-

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

Kim takes one-shot lead over Thomas, Novak at RBC Heritage

-

Another round of anti-Trump protests hits US cities

-

'So grateful' - Dodgers star Ohtani and wife welcome first child

'So grateful' - Dodgers star Ohtani and wife welcome first child

-

PSG maintain unbeaten Ligue 1 record, Marseille back up to second

-

US, Iran report progress in nuclear talks, will meet again

US, Iran report progress in nuclear talks, will meet again

-

US Supreme Court intervenes to block Trump deportations

-

Hamas armed wing says fate of US-Israeli captive unknown

Hamas armed wing says fate of US-Israeli captive unknown

-

Pacers thump Bucks to open NBA playoffs

-

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

Sabalenka reaches Stuttgart semis as Ostapenko extends Swiatek mastery

-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

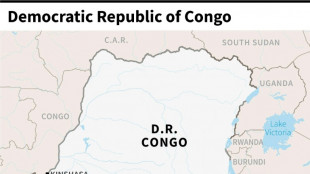

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

Credit Suisse to pay $495 mn in US to settle securities case

Credit Suisse said Monday it would pay $495 million to settle a row over mortgage-backed securities dating back to the 2008 financial crisis.

Switzerland's second-biggest bank said it had agreed with New Jersey authorities to make the "one-time payment... to fully resolve claims" for compensation, and said it had already provisioned the amount.

In the claim filed in 2013, Credit Suisse was criticised for not having provided sufficient information on the risks relating to $10 billion of mortgage-backed securities.

Subprime mortgages, credit granted to borrowers often with poor credit histories or insufficient income, were packaged into financial products and sold to investors.

But as borrowers defaulted on many of those mortgages, investors had no way of telling what portion of the loans in the derivatives were bad.

Those products were at the heart of the 2008 financial crisis, which sparked a global recession and brought the international financial system to the brink of collapse.

Credit Suisse said the final settlement with the New Jersey Attorney General allowed it "to resolve the only remaining RMBS (residential mortgage-backed securities) matter involving claims by a regulator and the largest of its remaining exposures on its legacy RMBS docket".

Shares rose after the statement on the SMI, the flagship index of the Swiss Stock Exchange.

Speculation has been growing ahead of an update scheduled by the new chief executive for later this month.

According to the Financial Times, the bank is considering not only disposals in its investment bank but also the sale of some of its domestic activities in Switzerland.

- Financial crisis fines -

In January 2017, US authorities forced Credit Suisse to pay out $5.28 billion over its role in the subprime crisis -- three years after it was fined $2.6 billion for helping Americans avoid taxes.

Last year, Credit Suisse also paid $600 million to financial guarantee insurer MIBA to settle other long-running litigation connected to the US subprime mortgage crisis.

The bank said last January it was increasing the provisions set aside for the MBIA case and others involving mortgage backed securities by $850 million.

Some of the world's biggest banks have also faced legal claims after the 2008 financial crash.

German banking giant Deutsche Bank agreed in December 2016 to pay $7.2 billion to settle a case with the US Department of Justice.

And British banking giant Barclays reached a deal in 2018 to pay a US fine of $2 billion over a fraud case involving subprime mortgage derivatives.

The Bank of America meanwhile agreed to a $17 billion deal with US authorities in 2014 to settle claims it sold risky mortgage securities as safe investments ahead of the 2008 financial crisis.

Ch.Havering--AMWN