-

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

Zelensky says Ukraine will observe Putin's Easter truce but claims violations

-

'Fuming' Watkins fires Villa in bid to prove Emery wrong

-

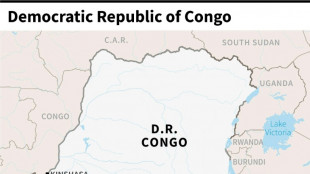

DR Congo boat fire toll revised down to 33

DR Congo boat fire toll revised down to 33

-

England thrash Scotland to set up France Grand Slam showdown

-

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

Verstappen's Red Bull 'comes alive' to claim record pole in Jeddah

-

McTominay fires Napoli level with Inter as Conte fuels exit rumours

-

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

Rajasthan unleash Suryavanshi, 14, as youngest IPL player but lose thriller

-

Man City boost top five bid, Aston Villa thrash in-form Newcastle

-

Villa rout Newcastle to rekindle bid to reach Champions League

Villa rout Newcastle to rekindle bid to reach Champions League

-

Dumornay gives Lyon lead over Arsenal in Women's Champions League semis

-

Trans rights supporters rally in London, Edinburgh after landmark ruling

Trans rights supporters rally in London, Edinburgh after landmark ruling

-

'We have to wait': Barca's Flick on Lewandowski injury fear

-

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

Bordeaux-Begles backups edge Pau to close in on Top 14 summit

-

Trans rights supporters rally outside in London, Edinburgh after landmark ruling

-

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

PSG beat Le Havre to stay on course for unbeaten Ligue 1 season

-

Man City close in on Champions League with Everton late show

-

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

14-year-old Vaibhav Suryavanshi becomes youngest IPL player

-

Barca make stunning comeback to beat Celta Vigo in Liga thriller

-

Zverev sets up birthday bash with Shelton in Munich

Zverev sets up birthday bash with Shelton in Munich

-

Man City boost top five bid, Southampton snatch late leveller

-

US Supreme Court intervenes to pause Trump deportations

US Supreme Court intervenes to pause Trump deportations

-

Alcaraz and Rune race into Barcelona final

-

US, Iran to hold more nuclear talks after latest round

US, Iran to hold more nuclear talks after latest round

-

Man City close in on Champions League thanks to Everton late show

-

Bayern close in on Bundesliga title with Heidenheim thumping

Bayern close in on Bundesliga title with Heidenheim thumping

-

Tunisia opposition figures get jail terms in mass trial

-

Putin announces 'Easter truce' in Ukraine

Putin announces 'Easter truce' in Ukraine

-

McLaren duo in ominous show of force in Saudi final practice

-

Afghan PM condemns Pakistan's 'unilateral' deportations

Afghan PM condemns Pakistan's 'unilateral' deportations

-

Iran says to hold more nuclear talks with US after latest round

-

Comeback queen Liu leads US to World Team Trophy win

Comeback queen Liu leads US to World Team Trophy win

-

Buttler fires Gujarat to top of IPL table in intense heat

-

Unimpressive France stay on course for Grand Slam showdown

Unimpressive France stay on course for Grand Slam showdown

-

Shelton fights past Cerundolo to reach Munich ATP final

-

Vance and Francis: divergent values but shared ideas

Vance and Francis: divergent values but shared ideas

-

Iran, US conclude second round of high-stakes nuclear talks in Rome

-

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

Dumornay gives Lyon first leg lead over Arsenal in women's Champions League semis

-

Trans rights supporters rally outside UK parliament after landmark ruling

-

Rune destroys Khachanov to reach Barcelona Open final

Rune destroys Khachanov to reach Barcelona Open final

-

From Messi to Trump, AI action figures are the rage

-

Vance discusses migration during Vatican meeting with pope's right-hand man

Vance discusses migration during Vatican meeting with pope's right-hand man

-

Afghan FM tells Pakistan's top diplomat deportations are 'disappointment'

-

British cycling icon Hoy and wife provide solace for each other's ills

British cycling icon Hoy and wife provide solace for each other's ills

-

Money, power, violence in high-stakes Philippine elections

-

Iran, US hold second round of high-stakes nuclear talks in Rome

Iran, US hold second round of high-stakes nuclear talks in Rome

-

Japanese warships dock at Cambodia's Chinese-renovated naval base

-

US Supreme Court pauses deportation of Venezuelans from Texas

US Supreme Court pauses deportation of Venezuelans from Texas

-

Pakistan foreign minister arrives in Kabul as Afghan deportations rise

-

Heat and Grizzlies take final spots in the NBA playoffs

Heat and Grizzlies take final spots in the NBA playoffs

-

Iran, US to hold second round of high-stakes nuclear talks in Rome

UK housing market hit by budget fallout

Britain's housing market has been rocked by the UK government's costly budget, as retail banks pull mortgage rates in anticipation of more costly products, sparking fears of tumbling home prices.

Homebuyers are gripped by panic after the Bank of England declared it would not hesitate to lift its main interest rate in response to the government's anticipated borrowing splurge that many see as further fuelling sky-high inflation.

- 'Torrid week' -

"It has been a torrid week for the mortgage market," Sarah Coles, personal finance analyst at broker Hargreaves Lansdown, told AFP.

Home-loan providers, which offer mortgages based on the central bank's rate, have scrapped about 40 percent of available products since the budget on September 23, according to data provider Moneyfacts.

That equates to more than 1,600 mortgage rates offered for a fixed period of time.

Coles said "the market struggled to function normally" as the pound struck a record-low against the dollar following the economic plan announced by the government of new Prime Minister Liz Truss.

The central bank reacted by launching emergency purchases of long-dated UK government bonds as soaring yields put pension funds at risk of collapse.

"Lenders withdrew (mortgage) rates for new customers while they waited for the dust to settle," said Coles.

"Once things feel more functional, they will be back but at a higher rate."

Major UK bank Barclays said that "due to high demand" it "withdrew a small number of mortgage products from sale for new customers".

For some time, the average mortgage rate has hovered around two percent for a fix lasting between two and five years, according to Moneyfacts.

However, those same mortgage deals are now approaching five percent, more than doubling monthly repayment costs.

- Added costs -

Tom Bill, head of UK residential research at Knight Frank, told AFP that mortgage holders could find themselves paying an additional "hundreds of pounds per month, that they're going to have to find", adding to the cost-of-living crisis.

The removal of mortgage deals "is a bitter pill to swallow for those who want to move and those with fixed terms due to end", said Tim Bannister, a director at online property firm Rightmove.

"And it will impact buyers' budgets, especially those who were already stretching themselves."

Richard Donell, executive director of online property group Zoopla, said rising mortgage rates "have been brewing for some time".

The Bank of England has in less than a year hiked its interest rate to 2.25 percent from a record-low 0.1 percent in a bid to cool decades-high inflation.

Experts are predicting the BoE's rate will peak close to six percent in the first half of next year. Before the budget, the market consensus forecast had been for a four-percent pinnacle.

- House prices to slump? -

Analysts are meanwhile predicting that British house prices are heading for a protracted slump after soaring in recent times as demand outpaces supply.

The average British home price surged 9.5 percent in September from a year earlier, home loans provider Nationwide revealed on Friday.

However prices were flat last month compared with August.

"The stall in house prices in September was little surprise given the growing downward pressure on demand from rising mortgage rates," said Capital Economics analyst Andrew Wishart.

"This marks the beginning of the most significant correction in house prices since 2007", when the global financial crisis began to emerge.

In his budget, finance minister Kwasi Kwarteng lifted the point at which tax is levied on purchases of residential properties -- a benefit that has seemingly been wiped out by the shake up of mortgage rates.

P.Mathewson--AMWN