-

NATO chief says alliance with US 'there to stay'

NATO chief says alliance with US 'there to stay'

-

Myanmar junta declares quake ceasefire as survivors plead for aid

-

American Neilson Powless fools Visma to win Around Flanders

American Neilson Powless fools Visma to win Around Flanders

-

Tesla first quarter sales sink amid anger over Musk politics

-

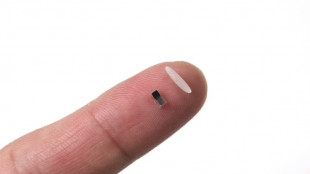

World's tiniest pacemaker is smaller than grain of rice

World's tiniest pacemaker is smaller than grain of rice

-

Judge dismisses corruption case against NY mayor

-

Nintendo to launch Switch 2 console on June 5

Nintendo to launch Switch 2 console on June 5

-

France Le Pen eyes 2027 vote, says swift appeal 'good news'

-

Postecoglou hopes Pochettino gets Spurs return wish

Postecoglou hopes Pochettino gets Spurs return wish

-

US, European stocks fall as looming Trump tariffs raise fears

-

Nintendo says Switch 2 console to be launched on June 5

Nintendo says Switch 2 console to be launched on June 5

-

France's Zemmour fined 10,000 euros over claim WWII leader 'saved' Jews

-

Le Pen ally denies planned rally a 'power play' against conviction

Le Pen ally denies planned rally a 'power play' against conviction

-

Letsile Tebogo says athletics saved him from life of crime

-

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

Man Utd 'on right track' despite 13th Premier League defeat: Dalot

-

Israel says expanding Gaza offensive to seize 'large areas'

-

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

Certain foreign firms must 'self-certify' with Trump diversity rules: US embassies

-

Deutsche Bank asset manager DWS fined 25 mn euros for 'greenwashing'

-

UK drawing up new action plan to tackle rising TB

UK drawing up new action plan to tackle rising TB

-

Nigerian president sacks board of state oil company

-

Barca never had financial room to register Olmo: La Liga

Barca never had financial room to register Olmo: La Liga

-

Spain prosecutors to appeal ruling overturning Alves' rape conviction

-

Heathrow 'warned about power supply' days before shutdown

Heathrow 'warned about power supply' days before shutdown

-

Epstein accuser Virginia Giuffre 'stable' after car crash

-

Myanmar quake survivors plead for more help

Myanmar quake survivors plead for more help

-

Greece to spend 25 bn euros in 'drastic' defence overhaul: PM

-

Maresca non-committal over Sancho's future at Chelsea

Maresca non-committal over Sancho's future at Chelsea

-

WHO facing $2.5-bn gap even after slashing budget: report

-

Real Madrid coach Ancelotti tells tax trial did not seek to defraud

Real Madrid coach Ancelotti tells tax trial did not seek to defraud

-

Chinese tourists pine for Taiwan's return as Beijing jets surround island

-

Singapore detains teenage boy allegedly planning to kill Muslims

Singapore detains teenage boy allegedly planning to kill Muslims

-

What is the 'Qatargate' scandal roiling Israel?

-

AI coming for anime but Ghibli's Miyazaki irreplaceable, son says

AI coming for anime but Ghibli's Miyazaki irreplaceable, son says

-

Swedish insurer drops $160 mn Tesla stake over labour rights

-

Hunger returns to Gaza as Israeli blockade forces bakeries shut

Hunger returns to Gaza as Israeli blockade forces bakeries shut

-

Rubio heads to Europe as transatlantic tensions soar

-

Like 'living in hell': Quake-hit Mandalay monastery clears away rubble

Like 'living in hell': Quake-hit Mandalay monastery clears away rubble

-

'Give me a break': Trump tariffs threaten Japan auto sector

-

US approves $5.58 bn fighter jet sale to Philippines

US approves $5.58 bn fighter jet sale to Philippines

-

Tsunoda embracing pressure of Red Bull debut at home Japanese GP

-

'Outstanding' Hay shines as New Zealand seal Pakistan ODI series

'Outstanding' Hay shines as New Zealand seal Pakistan ODI series

-

El Salvador's Bukele flaunts 'iron fist' alliance with Trump

-

Stock markets mixed as uncertainty rules ahead of Trump tariffs

Stock markets mixed as uncertainty rules ahead of Trump tariffs

-

China probes for key target weak spots with 'paralysing' Taiwan drills

-

'Top Gun' and Batman star Val Kilmer dies aged 65: New York Times

'Top Gun' and Batman star Val Kilmer dies aged 65: New York Times

-

US lawmakers seek to rename street for Hong Kong's jailed Jimmy Lai

-

Greece to spend big on 'historic' military shake up

Greece to spend big on 'historic' military shake up

-

Trump faces first electoral setback after Wisconsin Supreme Court vote

-

Hay shines as New Zealand beat Pakistan for ODI series win

Hay shines as New Zealand beat Pakistan for ODI series win

-

Israel says expands Gaza offensive to seize 'large areas'

| RBGPF | 0% | 68 | $ | |

| CMSC | -0.09% | 22.42 | $ | |

| GSK | -1.21% | 37.417 | $ | |

| AZN | -0.03% | 72.58 | $ | |

| BP | -0.25% | 33.725 | $ | |

| NGG | 0.18% | 65.9 | $ | |

| BTI | -1.64% | 40.435 | $ | |

| SCS | 0.75% | 11.405 | $ | |

| RELX | 0.12% | 50.73 | $ | |

| BCC | 1.01% | 99.915 | $ | |

| RIO | -0.97% | 59.65 | $ | |

| RYCEF | -1.82% | 9.87 | $ | |

| CMSD | -0.18% | 22.78 | $ | |

| JRI | -0.17% | 12.958 | $ | |

| BCE | -3.03% | 22.11 | $ | |

| VOD | -1.48% | 9.135 | $ |

Interactive Strength Inc. (Nasdaq: TRNR) Reports Fourth Quarter & Year-End 2024 Results

Company Delivers Quarterly Revenue of $2.4 Million as Projected or $5.4 Million for full-year 2024

Quarterly Net Loss and Earnings per Diluted Share of $5.8 Million and $7.26

Quarterly Adjusted EBITDA Loss of $1.9 Million Reflects 42% Improvement YOY and 19% Sequentially

Stockholders' Equity Was $7.1 Million at Year End

Pending Acquisitions Remain on Track; TRNR Expects More than $50M in 2025 Pro Forma Revenue

AUSTIN, TX / ACCESS Newswire / March 31, 2025 / Interactive Strength Inc. (Nasdaq:TRNR) ("TRNR" or the "Company"), maker of innovative specialty fitness equipment under the CLMBR and FORME brands, today announced its financial results for the fourth quarter and full-year of 2024.

The Company delivered on its projected quarterly revenue guidance of $2.4 Million - $5.4 million for the full-year - incurring a net quarterly loss of $5.8 million, or $7.26 per diluted share, compared to a loss of $11.4 million and $3,214.88 per share in the same period in 2023.

Quarterly adjusted EBITDA, a non-GAAP financial measure, was a loss of $1.9 million, which reflects improved operational performance and represents the highest quarterly revenue to date. For more information regarding the non-GAAP financial measures discussed in this press release, please see "Non-GAAP Financial Measures" and "Reconciliation of GAAP to Non-GAAP Financial Measures" below.

Trent Ward, CEO and Co-Founder of TRNR, said: "2024 ended on a high note with revenues growing as projected and losses shrinking - laying a strong foundation for execution against our acquisition strategy in 2025. We continued to improve our balance sheet and stockholders' equity, further stabilizing our listing. We also kept building our international distribution and sales network, driving organic revenue growth during the quarter. We will provide additional color on our strategy and performance in our second quarterly shareholder letter, which will be posted on our investor website, as well as our 10-K after market close today."

For more commentary, information and details of TRNR's strategy, as well as to sign up for direct updates, see the Company's investor website as well as its investor deck and required filings with the US Securities & Exchange Commission (SEC).

TRNR Investor Contact

TRNR Media Contact

About Interactive Strength Inc.:

Interactive Strength Inc. produces innovative specialty fitness equipment and digital fitness services under two main brands: 1) CLMBR and 2) FORME. Interactive Strength Inc. is listed on NASDAQ (symbol: TRNR).

CLMBR is a vertical climbing machine that offers an efficient and effective full-body strength and cardio workout. CLMBR's design is compact and easy to move - making it perfect for commercial or in-home use. With its low impact and ergonomic movement, CLMBR is safe for most ages and levels of ability and can be found at gyms and fitness studios, hotels, and physical therapy facilities, as well as available for consumers at home. www.clmbr.com.

FORME is a digital fitness platform that combines premium smart gyms with live virtual personal training and coaching to deliver an immersive experience and better outcomes for both consumers and trainers. FORME delivers an immersive and dynamic fitness experience through two connected hardware products: 1) The FORME Studio Lift (fitness mirror and cable-based digital resistance) and 2) The FORME Studio (fitness mirror). In addition to the company's connected fitness hardware products, FORME offers expert personal training and health coaching in different formats and price points through Video On-Demand, Custom Training, and Live 1:1 virtual personal training. www.formelife.com .

Channels for Disclosure of Information

In compliance with disclosure obligations under Regulation FD, we announce material information to the public through a variety of means, including filings with the Securities and Exchange Commission ("SEC"), press releases, company blog posts, public conference calls, and webcasts, as well as via our investor relations website. Any updates to the list of disclosure channels through which we may announce information will be posted on the investor relations page on our website. The inclusion of our website address or the address of any third-party sites in this press release are intended as inactive textual references only.

Non-GAAP Financial Measures

In addition to our results determined in accordance with accounting principles generally accepted in the United States, or GAAP, we believe the following non-GAAP financial measures are useful in evaluating our operating performance.

The Company's non-GAAP financial measure in this press release consist of Adjusted EBITDA, which we define as net (loss) income, adjusted to exclude: other expense (income), net; income tax expense (benefit); depreciation and amortization expense; stock-based compensation expense; loss on debt extinguishment; vendor settlements; transaction related expenses; and IPO readiness costs and expenses.

The Company believes the above adjusted financial measures help facilitate analysis of operating performance and the operating leverage in our business. We believe that these non-GAAP financial measures are useful to investors for period-to-period comparisons of our business and in understanding and evaluating our operating results for the following reasons:

Adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance without regard to items such as stock-based compensation expense, depreciation and amortization expense, other expense (income), net, and provision for income taxes that can vary substantially from company to company depending upon their financing, capital structures, and the method by which assets were acquired;

Our management uses Adjusted EBITDA in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance; and

Adjusted EBITDA provides consistency and comparability with our past financial performance, facilitate period-to-period comparisons of our core operating results, and may also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results.

Our use of Adjusted EBITDA, or any other non-GAAP financial measures we may use in the future, is presented for supplemental informational purposes only and should not be considered as a substitute for, or in isolation from, our financial results presented in accordance with GAAP. Further, these non-GAAP financial measures have limitations as analytical tools. Some of these limitations are, or may in the future be, as follows:

Although depreciation and amortization expense are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

Adjusted EBITDA excludes stock-based compensation expense, which has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy;

Adjusted EBITDA does not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (3) tax payments that may represent a reduction in cash available to us;

Adjusted EBITDA does not reflect impairment charges for fixed assets and capitalized content, and gains (losses) on disposals for fixed assets;

Adjusted EBITDA does not reflect gains associated with debt extinguishments.

Adjusted EBITDA does not reflect gains associated with vendor settlements.

Adjusted EBITDA does not reflect non cash fair value gains (losses) on convertible notes, warrants and unrealized currency gains (losses).

Further, the non-GAAP financial measures presented may not be comparable to similarly titled measures reported by other companies due to differences in the way that these measures are calculated. For example, the expenses and other items that we exclude in our calculation of Adjusted EBITDA may differ from the expenses and other items, if any, that other companies may exclude from Adjusted EBITDA when they report their operating results. Because companies in our industry may calculate such measures differently than we do, their usefulness as comparative measures is limited. Because of these limitations, Adjusted EBITDA should be considered along with other operating and financial performance measures presented in accordance with GAAP.

Forward Looking Statements:

This press release includes certain statements that are "forward-looking statements" for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements do not relate strictly to historical or current facts and reflect management's assumptions, views, plans, objectives and projections about the future. Forward-looking statements generally are accompanied by words such as "believe", "project", "expect", "anticipate", "estimate", "intend", "strategy", "future", "opportunity", "plan", "may", "should", "will", "would", "will be", "will continue", "will likely result" or similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the possibility of acquiring future businesses or completing the referenced pending transactions in a timely manner or at all, the financial performance of those acquisitions and the resulting guidance of having more than $50m of pro forma revenue in 2025. The reader is cautioned not to rely on these forward-looking statements. These statements are based on current expectations of future events. If underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the expectations and projections of the Company. Risks and uncertainties include but are not limited to: demand for our products; competition, including technological advances made by and new products released by our competitors; our ability to accurately forecast consumer demand for our products and adequately maintain our inventory; and our reliance on a limited number of suppliers and distributors for our products. A further list and descriptions of these risks, uncertainties and other factors can be found in filings with the Securities and Exchange Commission. To the extent permitted under applicable law, the Company assumes no obligation to update any forward-looking statements.

# # #

SOURCE: Interactive Strength Inc.

View the original press release on ACCESS Newswire

D.Kaufman--AMWN