-

Hamilton rubbishes claims he's lost faith in Ferrari

Hamilton rubbishes claims he's lost faith in Ferrari

-

Nintendo Switch 2 sparks excitement despite high price

-

Sri Lanka's crackdown on dogs for India PM's visit sparks protest

Sri Lanka's crackdown on dogs for India PM's visit sparks protest

-

S Korea police raise security levels ahead of impeachment verdict

-

China vows 'countermeasures' to sweeping new US tariffs

China vows 'countermeasures' to sweeping new US tariffs

-

Trump jolts allies, foes and markets with tariff blitz

-

France says EU to target US online services after Trump tariffs

France says EU to target US online services after Trump tariffs

-

Tsunoda vows to bring 'something different' after Red Bull promotion

-

Verstappen not happy with Tsunoda-Lawson Red Bull swap

Verstappen not happy with Tsunoda-Lawson Red Bull swap

-

Experts accuse 54 top Nicaragua officials of grave abuses

-

Remains of 30th victim of Los Angeles fires found

Remains of 30th victim of Los Angeles fires found

-

EU to target US online services after Trump tariffs: France

-

How Trump's 'liberation day' tariffs will impact China

How Trump's 'liberation day' tariffs will impact China

-

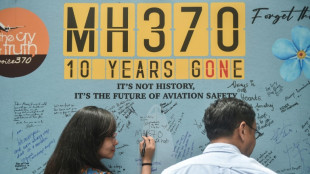

Malaysia suspends search for long-missing flight MH370

-

Search for long-missing flight MH370 suspended: Malaysia minister

Search for long-missing flight MH370 suspended: Malaysia minister

-

Europe hits out at Trump tariffs, keeps door open for talks

-

Myanmar's junta chief to head to Bangkok summit as quake toll surpasses 3,000

Myanmar's junta chief to head to Bangkok summit as quake toll surpasses 3,000

-

Lawson vows to prove he belongs in F1 after shock of Red Bull axing

-

Australia sweats through hottest 12 months on record: official data

Australia sweats through hottest 12 months on record: official data

-

Livestock theft is central to jihadist economy in west Africa

-

South African artist champions hyenas in 'eco-queer' quest

South African artist champions hyenas in 'eco-queer' quest

-

Danish PM in 'unity' Greenland visit amid US takeover threats

-

Taiwan says US tariffs 'highly unreasonable'

Taiwan says US tariffs 'highly unreasonable'

-

Lawson says ruthless Red Bull axing was 'tough to hear'

-

Heat humble Celtics for sixth straight win, Thunder roll on

Heat humble Celtics for sixth straight win, Thunder roll on

-

Trump escalates trade war with sweeping global tariffs

-

Japan says US tariffs 'extremely regrettable', may break WTO rules

Japan says US tariffs 'extremely regrettable', may break WTO rules

-

South Koreans anxious, angry as court to rule on impeached president

-

Juve at in-form Roma with Champions League in the balance

Juve at in-form Roma with Champions League in the balance

-

Injuries put undermanned Bayern's title bid to the test

-

Ovechkin scores 892nd goal -- three away from Gretzky's NHL record

Ovechkin scores 892nd goal -- three away from Gretzky's NHL record

-

Australian former rugby star Petaia signs for NFL's Chargers

-

China says opposes new US tariffs, vows 'countermeasures'

China says opposes new US tariffs, vows 'countermeasures'

-

Athletics world watching as 'Grand Slam Track' prepares for launch

-

Heat humble Celtics for sixth straight win, Cavs top Knicks

Heat humble Celtics for sixth straight win, Cavs top Knicks

-

Quake-hit Myanmar's junta chief to head to Bangkok summit

-

New Spielberg, Nolan films teased at CinemaCon

New Spielberg, Nolan films teased at CinemaCon

-

Shaken NATO allies to meet Trump's top diplomat

-

Israel's Netanyahu arrives in Hungary, defying ICC warrant

Israel's Netanyahu arrives in Hungary, defying ICC warrant

-

Shiny and deadly, unexploded munitions a threat to Gaza children

-

Stocks tank, havens rally as Trump tariffs fan trade war

Stocks tank, havens rally as Trump tariffs fan trade war

-

Altomare hangs on to tie defending champ Korda at LPGA Match Play

-

Paraguay gold rush leaves tea producers bitter

Paraguay gold rush leaves tea producers bitter

-

Health concerns swirl as Bolivian city drowns in rubbish

-

Syria says deadly Israeli strikes a 'blatant violation'

Syria says deadly Israeli strikes a 'blatant violation'

-

Financial markets tumble after Trump tariff announcement

-

Starbucks faces new hot spill lawsuits weeks after $50mn ruling

Starbucks faces new hot spill lawsuits weeks after $50mn ruling

-

Europe riled, but plans cool-headed response to Trump's tariffs

-

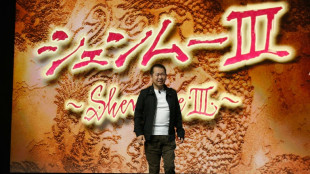

'Shenmue' voted most influential video game ever in UK poll

'Shenmue' voted most influential video game ever in UK poll

-

New coal capacity hit 20-year low in 2024: report

Despite high gas prices, US refiners strain to meet summer demand

Only time will tell how much record US prices at the pump will dent driving demand this summer, but don't expect a significant increase in gasoline supply from American refineries.

The reason: Several US gasoline refineries have shut down in recent years, or been converted to make other fuels, crimping America's refining capacity and exacerbating the hit from high crude oil prices in the current energy crunch.

US refineries operated at 93.2 percent last week, the loftiest level since December 2019 and an exceptionally high rate for a season normally associated with plant maintenance.

It all points to a stressed US energy system ahead of the summer driving season, which kicks off this weekend with the Memorial Day holiday.

"We're set for failure," said Robert Yawger an analyst at Mizuho Securities. "Basically, we're set for high prices, increasing inflation, and it doesn't bode well."

But limited refining capacity is also a global problem, according to a note from the Eurasia Group that described a tight fuel market with little relief in site.

"Increased demand is outstripping both storage and production capacity, leading to shortages," Eurasia Group said.

"Right now, demand is drawing down that storage much faster than it can be replaced, depleting inventories and driving refined product prices higher. While International Energy Agency data from this week shows global refinery throughput capacity increasing, it still remains below pre-pandemic levels."

Besides lifting crude prices, the Ukraine invasion has also pinched supplies of some refined products exported from Russia, especially low-quality gasoil.

- Plants are converted, closed -

Gasoline prices in the United States have soared more than 70 percent in last year to record levels, nationally averaging about $4.60 per gallon. Analysts at JPMorgan Chase believe prices go higher still this summer, surpassing $6.00 a gallon.

The number of active US refineries has fallen 13 percent in the last decade and now stands at the lowest level in the modern era.

The list of closures includes the Philadelphia Energy Solutions plant, which had been the largest in the northeastern United States prior to being shuttered in June 2019 following an explosion.

This group includes some refineries that were suspended early in the pandemic as fuel demand sank. Some, such as Marathon Petroleum's refinery in New Mexico, were never restarted.

The issue has "become a greater concern here in the United States as we've shut down a million barrels a day of refining capacity over the last year," said Andy Lipow of Lipow Oil Associates.

Large US refineries have also been shifting some of their capacity to biofuels and other renewable fuels in light of policies to address climate change favored by investors who prioritize environmental, social and governance (ESG) goals.

At its Cheyenne, Wyoming refinery, HollyFrontier is converting a 52,000 barrel a day refinery from gasoline production to renewable diesel.

- Dwindling market share -

But many in the oil industry are loath to undertake significant new refinery projects in light of the heavy investments by automakers like General Motors and Ford building electric vehicles that will lower gasoline's market share as a transport fuel.

Major airlines have also pledged to use more renewable fuels, lowering demand for jet fuel, another product at petroleum refineries.

Experts also pointed to policies such as ban on the sale of new gasoline-fired cars after 2035 that is being considered by the European Union.

"Laws like that are a clear signal that demand for your product at some point is going to go down," said Bill O'Grady of Confluence Investment Management. "There is very little incentive to invest."

Building a new refinery requires extensive capital, years of planning and regulatory approvals and would not pay off for 10-20 years, said Richard Sweeney, a professor of economics and the economy at Boston College.

"Gas prices are very, very high and diesel prices are very, very high," said Sweeney, adding, "I don't think anyone thinks that's going to last years."

Many refiners are steering extra cash made from today's strong market towards dividends and shareholder buybacks, which are favored on Wall Street.

The last major US refinery in the United States opened in 1977 and there have only been five new plants in the last 20 years, all smaller refineries.

When refiners have added significant capacity, it has been through expansions of existing plants rather than greenfield projects.

"No community wants a refinery," said O'Grady. "They're dirty. They explode. They smell bad."

The current global refining predicament is built on a "false assumption that we can do without refining," said Phil Flynn of the Price Futures Group.

"We're going to have to balance our ESG dreams versus the reality of trying to keep the market supplied with the products."

P.Martin--AMWN