-

Syrians protest after video of attack on Alawite shrine

Syrians protest after video of attack on Alawite shrine

-

Russian state owner says cargo ship blast was 'terrorist attack'

-

38 dead as Azerbaijani jet crashes in Kazakhstan

38 dead as Azerbaijani jet crashes in Kazakhstan

-

Crisis-hit Valencia hire West Brom's Corberan as new boss

-

Suriname ex-dictator and fugitive Desi Bouterse dead at 79

Suriname ex-dictator and fugitive Desi Bouterse dead at 79

-

35 feared dead as Azerbaijani jet crashes in Kazakhstan

-

Pope calls for 'arms to be silenced' in Christmas appeal

Pope calls for 'arms to be silenced' in Christmas appeal

-

Syria authorities say torched 1 million captagon pills

-

Pope calls for 'arms to be silenced' across world

Pope calls for 'arms to be silenced' across world

-

32 survivors as Azerbaijani jet crashes in Kazakhstan

-

Pakistan air strikes kill 46 in Afghanistan, Kabul says

Pakistan air strikes kill 46 in Afghanistan, Kabul says

-

Liverpool host Foxes, Arsenal prepare for life without Saka

-

Japan FM raises 'serious concerns' over China military buildup

Japan FM raises 'serious concerns' over China military buildup

-

Pope's sombre message in Christmas under shadow of war

-

Zelensky condemns Russian 'inhumane' Christmas attack on energy grid

Zelensky condemns Russian 'inhumane' Christmas attack on energy grid

-

Sweeping Vietnam internet law comes into force

-

Pope kicks off Christmas under shadow of war

Pope kicks off Christmas under shadow of war

-

Catholics hold muted Christmas mass in Indonesia's Sharia stronghold

-

Japan's top diplomat in China to address 'challenges'

Japan's top diplomat in China to address 'challenges'

-

Thousands attend Christmas charity dinner in Buenos Aires

-

Demand for Japanese content booms post 'Shogun'

Demand for Japanese content booms post 'Shogun'

-

As India's Bollywood shifts, stars and snappers click

-

Mystery drones won't interfere with Santa's work: US tracker

Mystery drones won't interfere with Santa's work: US tracker

-

Djokovic eyes more Slam glory as Swiatek returns under doping cloud

-

Australia's in-form Head confirmed fit for Boxing Day Test

Australia's in-form Head confirmed fit for Boxing Day Test

-

Brazilian midfielder Oscar returns to Sao Paulo

-

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

'Wemby' and 'Ant-Man' to make NBA Christmas debuts

-

US agency focused on foreign disinformation shuts down

-

On Christmas Eve, Pope Francis launches holy Jubilee year

On Christmas Eve, Pope Francis launches holy Jubilee year

-

'Like a dream': AFP photographer's return to Syria

-

Chiefs seek top seed in holiday test for playoff-bound NFL teams

Chiefs seek top seed in holiday test for playoff-bound NFL teams

-

Panamanians protest 'public enemy' Trump's canal threat

-

Cyclone death toll in Mayotte rises to 39

Cyclone death toll in Mayotte rises to 39

-

Ecuador vice president says Noboa seeking her 'banishment'

-

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

Leicester boss Van Nistelrooy aware of 'bigger picture' as Liverpool await

-

Syria authorities say armed groups have agreed to disband

-

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

Maresca expects Man City to be in title hunt as he downplays Chelsea's chancs

-

Man Utd boss Amorim vows to stay on course despite Rashford row

-

South Africa opt for all-pace attack against Pakistan

South Africa opt for all-pace attack against Pakistan

-

Guardiola adamant Man City slump not all about Haaland

-

Global stocks mostly higher in thin pre-Christmas trade

Global stocks mostly higher in thin pre-Christmas trade

-

Bethlehem marks sombre Christmas under shadow of war

-

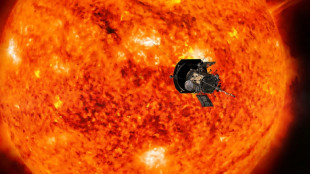

NASA probe makes closest ever pass by the Sun

NASA probe makes closest ever pass by the Sun

-

11 killed in blast at Turkey explosives plant

-

Indonesia considers parole for ex-terror chiefs: official

Indonesia considers parole for ex-terror chiefs: official

-

Global stocks mostly rise in thin pre-Christmas trade

-

Postecoglou says Spurs 'need to reinforce' in transfer window

Postecoglou says Spurs 'need to reinforce' in transfer window

-

Le Pen says days of new French govt numbered

-

Global stocks mostly rise after US tech rally

Global stocks mostly rise after US tech rally

-

Villa boss Emery set for 'very difficult' clash with Newcastle

Germany charges Wirecard's ex-CEO Braun over fraud

German prosecutors said Monday they have charged Wirecard's former chief executive Markus Braun and two other high-ranking managers for the colossal commercial fraud that led to the collapse of the payment company.

The trio are accused of market manipulation, embezzlement and gang fraud on a commercial scale, said prosecutors in Munich, noting that the indictment itself runs to 474 pages.

The German fintech company, once touted as a shining star of innovative start-ups, crashed in June 2020 after admitting that a missing 1.9 billion euros ($2.1 billion) from its balance sheets likely didn't exist.

The time it took for prosecutors to file formal charges underlined the intricate and complex web of fraudulent transactions implicating Wirecard subsidiaries and third-party companies that took investigators across the world to unravel.

Among victims of the fraud were banks that had provided credit of 1.7 billion euros to Wirecard. Bonds worth 1.4 billion euros had also been issued and are unlikely to be repaid.

"All the accused group members were acting in an industrial fashion in these six cases of fraud, because that is how they secured their own salaries, including partially profit-related portions," prosecutors said in a statement.

Braun for instance, received at least 5.5 million euros in dividends, they said.

- Years in prison? -

The other two accused are chief accountant Stephan von Erffa and director of Wirecard's Dubai subsidiary Oliver Bellenhaus.

Prosecutors said they risk "several years" in prison if found guilty.

The trio had presented "incorrect" accounts for the financial years 2015-2018 by allegedly including revenues from so-called third party acquirer (TPA) businesses -- companies that do not have their own licences to operate payment services or because they are involved in high-risk activities such as pornography or gambling.

However, the proceeds reported as arising from the TPAs -- three companies in Dubai, the Philippines and Singapore -- actually "did not actually exist," said prosecutors.

The funds held allegedly in the Singapore TPA which were accounted as reaching almost a billion euros, "never existed at any time".

Balance sheet confirmations were falsified by the alleged third-party trustee or by Bellenhaus on the orders of von Erffa, said prosecutors.

- 'Unparalleled' -

Founded in 1999, the Bavarian start-up Wirecard rose from a company piping cash to porn and gambling sites to a respectable electronic payments provider that edged traditional lender Commerzbank out of the DAX 30 index.

Hailed as a champion of the burgeoning financial technology scene, it boasted a market valuation of more than 23 billion euros at one point -- outweighing even giant Deutsche Bank.

Wirecard's troubles began in January 2019 with a series of articles in the Financial Times alleging accounting irregularities in its Asian division, headed by chief operating officer Jan Marsalek.

But the company was able, at that time, to repeatedly fend off the claims and the FT's journalists themselves came under investigation over the reports.

The huge scam unravelled in June 2020 when auditors EY said they were unable to find 1.9 billion euros of cash in the company's accounts.

The sum, which made up a quarter of the balance sheet, was supposedly held to cover risks in trading carried out by third parties on Wirecard's behalf and was meant to be sitting in trustee accounts at two Filippino banks.

But the Philippines' central bank has said the cash never entered its monetary system and both Asian banks, BDO and BPI, denied having a relationship with Wirecard.

While key figures in the company have since been detained, including Braun, the company's former COO Marsalek, who is wanted by German prosecutors, remains at large.

Prosecutors said efforts to hunt down Marsalek are "ongoing".

The scandal, described by then finance minister Olaf Scholz as "unparalleled" in Germany, sparked an overhaul of market oversight by regulator Bafin.

Th.Berger--AMWN