-

Austrian climber dies on Nepal mountain

Austrian climber dies on Nepal mountain

-

Fires rage 2 days after Iran port blast killed 46

-

Palestinian official tells ICJ Israel using aid blockage as 'weapon of war'

Palestinian official tells ICJ Israel using aid blockage as 'weapon of war'

-

France arrests 25 in police raids after prison attacks

-

Kim Kardashian's next star turn is in a Paris courtroom

Kim Kardashian's next star turn is in a Paris courtroom

-

Syria group says military chief arrested in UAE

-

Anger in Indian Kashmir at demolitions and detentions

Anger in Indian Kashmir at demolitions and detentions

-

Italy bank merger wave heats up as Mediobanca eyes Banca Generali

-

Putin critic Johann Wadephul, Germany's incoming foreign minister

Putin critic Johann Wadephul, Germany's incoming foreign minister

-

Cardinals expected to pick conclave date to elect new pope

-

French mosque murder suspect arrested in Italy

French mosque murder suspect arrested in Italy

-

China says on 'right side of history' in trade standoff with US

-

Stock markets mostly rise as investors eye trade talks

Stock markets mostly rise as investors eye trade talks

-

Fires rage 2 days after Iran port blast killed 40

-

Yemen's Huthi rebel media says 68 killed in US strikes on migrant centre

Yemen's Huthi rebel media says 68 killed in US strikes on migrant centre

-

Man rescued from Mount Fuji twice in one week: reports

-

Canada votes for new government to take on Trump

Canada votes for new government to take on Trump

-

Top UN court to open hearings on Israel's aid obligation to Palestinians

-

Philippines denies 'irresponsible' Chinese report on disputed reef

Philippines denies 'irresponsible' Chinese report on disputed reef

-

T'Wolves win to push Lakers to brink, Celtics, Knicks and Pacers win

-

Myanmar marks month of misery since historic quake

Myanmar marks month of misery since historic quake

-

South Korea's SK Telecom begins SIM card replacement after data breach

-

Women's flag football explodes in US as 2028 Olympics beckon

Women's flag football explodes in US as 2028 Olympics beckon

-

'Hunger breaks everything': desperate Gazans scramble for food

-

Suspect charged with murder in Canada car attack that killed 11

Suspect charged with murder in Canada car attack that killed 11

-

Lost to history: Myanmar heritage falls victim to quake

-

Romania far-right rides TikTok wave in election re-run

Romania far-right rides TikTok wave in election re-run

-

Trial begins in Paris over 2016 gunpoint robbery of Kim Kardashian

-

Trump thinks Zelensky ready to give up Crimea to Russia

Trump thinks Zelensky ready to give up Crimea to Russia

-

North Korea confirms troop deployment to Russia's Kursk

-

Romania presidential election re-run under Trump shadow

Romania presidential election re-run under Trump shadow

-

Asian markets mixed as investors eye trade talks

-

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

T'Wolves push Lakers to brink of elimination, Celtics and Knicks win

-

Suspect charged with murder in Canada car attack that left 11 dead

-

Smart driving new front in China car wars despite fatal crash

Smart driving new front in China car wars despite fatal crash

-

Cardinals set to pick conclave date to elect new pope

-

Miami's unbeaten MLS run ends after Dallas comeback

Miami's unbeaten MLS run ends after Dallas comeback

-

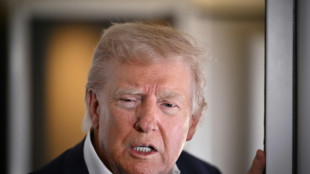

After 100 days in office, Trump voters still back US president

-

US anti-disinformation guardrails fall in Trump's first 100 days

US anti-disinformation guardrails fall in Trump's first 100 days

-

Dick Barnett, two-time NBA champ with Knicks, dies at 88

-

PSG hope to have Dembele firing for Arsenal Champions League showdown

PSG hope to have Dembele firing for Arsenal Champions League showdown

-

Arteta faces Champions League showdown with mentor Luis Enrique

-

Niemann wins LIV Mexico City to secure US Open berth

Niemann wins LIV Mexico City to secure US Open berth

-

Slot plots more Liverpool glory after Premier League triumph

-

Novak and Griffin win PGA pairs event for first tour titles

Novak and Griffin win PGA pairs event for first tour titles

-

Sichuan Week, China Pavilion at Expo 2025 Osaka, Kansai, Japan Kicks off Today, Showcasing Splendid Bashu Culture

-

Primary Hydrogen Engages Veteran Landman to Support U.S. Expansion

Primary Hydrogen Engages Veteran Landman to Support U.S. Expansion

-

Q2 Metals Extends Mineralized Zone Strike Length to 1.5 Kilometres and Concludes the 2025 Winter Program at the Cisco Lithium Project in Quebec, Canada

-

Empire Metals Limited - Extensive High-Grade Titanium Zones Confirmed

Empire Metals Limited - Extensive High-Grade Titanium Zones Confirmed

-

Hemogenyx Pharmaceuticals PLC Announces Final Results

India's Adani shares plunge again after stock sale cancelled

Under-fire Indian tycoon Gautam Adani insisted Thursday that the fundamentals of his conglomerate were "strong" even as shares in its companies plunged again after the group cancelled a multi-billion-dollar stock sale.

Adani's empire has lost more than $100 billion following explosive allegations of accounting fraud last week by US short-seller Hindenburg Research that the firm has rejected.

The sale of shares in Adani Enterprises had been intended to raise around $2.5 billion to help reduce debt levels -- which have long been a concern -- and broaden its shareholder base.

But small investors stayed away as the market price dropped below the offer range, and it was only fully subscribed after support from Abu Dhabi-based International Holding Company as well as, according to Bloomberg citing unidentified sources, fellow Indian tycoons Sajjan Jindal and Sunil Mittal.

Even so, Adani Enterprises' share price plunged another 28.45 percent in Mumbai on Wednesday.

The trigger was news that Swiss banking giant Credit Suisse had stopped accepting Adani bonds as collateral for loans it advances to private banking clients, Bloomberg reported.

Adani Enterprises lost another 10 percent, forcing trading to be suspended in its shares and several other Adani companies.

The Adani Enterprises board said in a late-night statement it had decided not to proceed with the share sale "in the interest of its subscribers" and all payments would be refunded.

The firm said that going ahead with the issue "would not be morally correct".

Adani himself issued a video statement on Thursday in which he insisted that the "fundamentals of our company are very strong, our balance sheet is healthy and assets robust".

The slide in Adani's personal wealth has seen him fall out of the top 10 real-time Forbes rich list and overtaken as Asia's richest man by fellow Indian Mukesh Ambani.

- 'Serious investigation' -

Publicity-shy Adani, 60, has seen his empire expand at breakneck speed, with shares in Adani Enterprises soaring more than a thousand percent over the past five years.

This helped him last week become the world's third-richest man behind Elon Musk and France's Bernard Arnault and family.

According to Hindenburg Research, Adani has artificially boosted the share prices of its units by funnelling money into the stocks through offshore tax havens.

This "brazen stock manipulation and accounting fraud scheme" is "the largest con in corporate history", Hindenburg said in its report.

Adani said it was the victim of a "maliciously mischievous" reputational attack and issued a 413-page statement on Sunday that said Hindenburg's claims were "nothing but a lie".

Hindenburg, which makes money by betting on stocks falling, said in response that Adani's statement failed to answer most of the questions raised in its report.

Critics say Adani's close relationship with Prime Minister Narendra Modi has helped him win business and avoid proper regulatory oversight.

Modi, who like Adani is from Gujarat state, has not commented publicly since the Hindenburg claims, which analysts say has hurt India's image just as it seeks to woo overseas investors away from China.

The firm's many interests include ports -- the firm took control of one of Israel's biggest this week -- telecoms, airports, media and coal, oil and solar power.

India's opposition Congress party called this week for a "serious investigation" by the central bank and regulator into Adani's firms following the Hindenburg allegations.

"For all its posturing about black money, has the Modi government chosen to turn a blind eye towards illicit activities by its favourite business group?" Congress said.

burs-stu/dan

P.Mathewson--AMWN