-

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

Chahal stars as Punjab defend IPL's lowest total of 111 in 'best win'

-

French swim star Marchand considered taking year-long break

-

Chahal stars as Punjab defend IPL's lowest total of 111

Chahal stars as Punjab defend IPL's lowest total of 111

-

Universal Studios, Venice Beach to host LA 2028 events

-

IOM chief urges world to step up aid for Haiti

IOM chief urges world to step up aid for Haiti

-

French prisons hit by mystery arson and gunfire attacks

-

Alcaraz follows Ruud into Barcelona Open last 16

Alcaraz follows Ruud into Barcelona Open last 16

-

Stocks rise on bank earnings, auto tariff hopes

-

Trump showdown with courts in spotlight at migrant hearing

Trump showdown with courts in spotlight at migrant hearing

-

Ecuador electoral council rejects claims of fraud in presidential vote

-

Russia jails four journalists who covered Navalny

Russia jails four journalists who covered Navalny

-

Trump says China 'reneged' on Boeing deal as tensions flare

-

Trump eyes near 50 percent cut in State Dept budget: US media

Trump eyes near 50 percent cut in State Dept budget: US media

-

Trump says would 'love' to send US citizens to El Salvador jail

-

'Unprecedented' Europe raids net 200 arrests, drugs haul

'Unprecedented' Europe raids net 200 arrests, drugs haul

-

Everyone thinks Real Madrid comeback 'nailed-on': Bellingham

-

NATO's Rutte says US-led Ukraine peace talks 'not easy'

NATO's Rutte says US-led Ukraine peace talks 'not easy'

-

Harvey Weinstein New York retrial for sex crimes begins

-

More than 10% of Afghans could lose healthcare by year-end: WHO

More than 10% of Afghans could lose healthcare by year-end: WHO

-

Stocks rise as auto shares surge on tariff break hopes

-

Facebook chief Zuckerberg testifying again in US antitrust trial

Facebook chief Zuckerberg testifying again in US antitrust trial

-

Pakistan court refuses to hear Baloch activist case: lawyers

-

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

Inzaghi pushing Inter to end San Siro hoodoo with Bayern and reach Champions League semis

-

Arsenal's Odegaard can prove point on Real Madrid return

-

China's Xi begins Malaysia visit in shadow of Trump tariffs

China's Xi begins Malaysia visit in shadow of Trump tariffs

-

Andrew Tate accusers suing for 'six-figure' sum, UK court hears

-

Macron to honour craftspeople who rebuilt Notre Dame

Macron to honour craftspeople who rebuilt Notre Dame

-

Van der Poel E3 'spitter' facing fine

-

Khamenei says Iran-US talks going well but may lead nowhere

Khamenei says Iran-US talks going well but may lead nowhere

-

Nearly 60,000 Afghans return from Pakistan in two weeks: IOM

-

Auto shares surge on tariff reprieve hopes

Auto shares surge on tariff reprieve hopes

-

Sudan war drains life from once-thriving island in capital's heart

-

Trump trade war casts pall in China's southern export heartland

Trump trade war casts pall in China's southern export heartland

-

Ukraine's Sumy prepares to bury victims of 'bloody Sunday'

-

Iraq sandstorm closes airports, puts 3,700 people in hospital

Iraq sandstorm closes airports, puts 3,700 people in hospital

-

French prisons targeted with arson, gunfire: ministry

-

Pandemic treaty talks inch towards deal

Pandemic treaty talks inch towards deal

-

Employee dead, client critical after Paris cryotherapy session goes wrong

-

Howe will only return to Newcastle dugout when '100 percent' ready

Howe will only return to Newcastle dugout when '100 percent' ready

-

Journalist recalls night Mario Vargas Llosa punched Gabriel Garcia Marquez

-

Sudan marks two years of war with no end in sight

Sudan marks two years of war with no end in sight

-

Vance urges Europe not to be US 'vassal'

-

China tells airlines to suspend Boeing jet deliveries: report

China tells airlines to suspend Boeing jet deliveries: report

-

Stocks rise as stability returns, autos surge on exemption hope

-

Harvard sees $2.2bn funding freeze after defying Trump

Harvard sees $2.2bn funding freeze after defying Trump

-

'Tough' Singapore election expected for non-Lee leader

-

Japan orders Google to cease alleged antitrust violation

Japan orders Google to cease alleged antitrust violation

-

Stocks rise as stability returns, autos lifted by exemption hope

-

Malawi's debt crisis deepens as aid cuts hurt

Malawi's debt crisis deepens as aid cuts hurt

-

Danish brewer adds AI 'colleagues' to human team

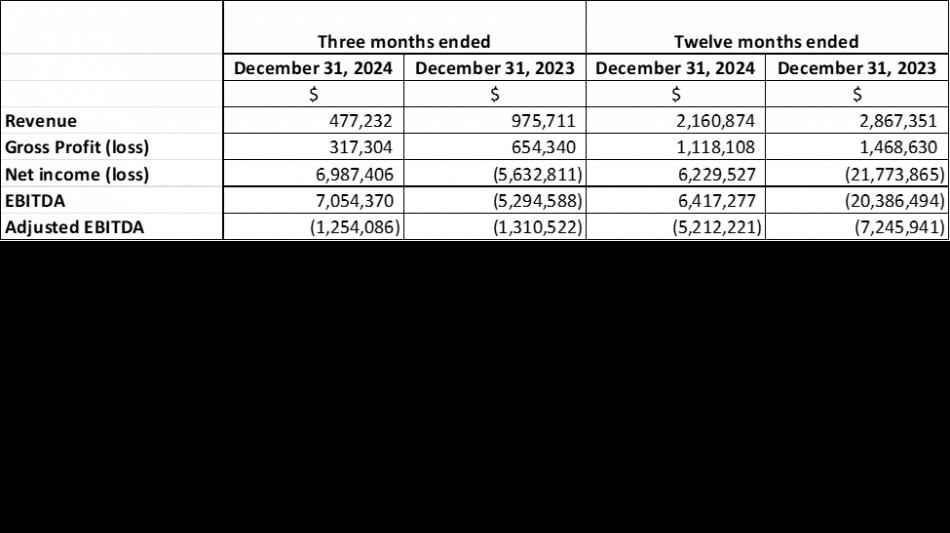

AmeriTrust Announces 2024 Annual Financial Results

TORONTO, ON / ACCESS Newswire / April 14, 2025 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTCQB:AMTFF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT" or the "Company"), a fintech platform targeting automotive finance, is announcing that it has filed its audited Consolidated Financial Statements and Management's Discussion and Analysis report for the years ended December 31, 2024, and 2023. These documents may be viewed under the Company's profile at www.sedarplus.ca.

Cash on hand at December 31, 2024, was $10,231,191 compared to $1,937,182 as at December 31, 2023. At December 31, 2024, the Company reported a working capital surplus of $4,002,995 as compared to a working capital deficit of $15,934,887 at December 31, 2023.

Revenue for the fourth quarter of 2024 decreased to $477,232 in comparison to Q4/2023 revenue of $975,711. The revenues are primarily generated from the servicing of lease contracts.

AmeriTrust's CEO Jeff Morgan commented: "When I returned to AmeriTrust one year ago the Company was facing many corporate, financial and legal issues that challenged its strategic plans and overall progress.

During the past year AmeriTrust was successful in closing on several private placements and raised over $13 million from existing and new shareholders who believe in the business model of AmeriTrust's used and new vehicle leasing technology platform.

Our new AmeriTrust Serves team has taken proactive steps to improve servicing, communication and collaboration with our primary credit union partners, working closely with them to resolve the issues that had previously resulted in a provision exceeding $11.0 million for potential loss on lease contracts. Following a comprehensive review of the lease portfolio and confirmation from the credit union that there are currently no financial claims or legal action against AmeriTrust, we revised our prior estimates and removed the loss provision from our year end Financial Statements. As a result, we are pleased to report Net Income for 2024 of $6.2 million and a working capital surplus of $4.0 million.

During the past twelve months we were also able to resolve many existing and pending lawsuits, some of which are reflected in the Financial Statements at year end, and others that were resolved or settled in the first quarter of 2025.

With the recapitalization of the Company's Balance Sheet, the removal of the loss provision on lease contracts, the resolution of lawsuits, and the strengthening of our management team throughout the year, AmeriTrust is now in a much stronger corporate and financial position. As I have mentioned in a previous press release, we are currently in discussions with several potential funding providers and are working diligently to finalize funding and will keep all shareholders apprised as to our progress."

About AmeriTrust Financial Technologies Inc.

AmeriTrust Financial Technologies Inc., listed on the TSX Venture Exchange, OTCQB, and Frankfurt markets, is a finance solution and fintech provider disrupting the automotive industry. AmeriTrust's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. AmeriTrust's platform is being made available across the United States.

For further information, please visit the AmeriTrust website or contact:

Shibu Abraham

Chief Financial Officer and Director

E: [email protected]

P: 1-800-600-6872

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release makes reference to "EBITDA" and "Adjusted EBIDTA" which are non-IFRS financial measures. The Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments there to provided herein have an actual effect on the Company's operating results.

"EBITDA" is defined as Earnings before Interest, Taxation, Depreciation and Amortization. Management believes this is a useful metric in evaluating the ongoing operating performance of the Company.

"Adjusted EBITDA" is defined as Earnings before Interest, Taxation, Depreciation, Amortization, Share Based Compensation expense, Provision for expected credit loss on lease contracts and revision to the provision, foreign exchange loss, and other one-time costs is an additional measure used by management to evaluate cash flows and the Company's ability to service debt. Adjusted EBITDA is a non-IFRS measure and should not be considered an alternative to operating income or net income (loss) in measuring the Company's performance.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, the intention to grow the business, operations, and existing and potential activities of the Company, future prospects of the Company, the ability of the Company to execute on its business plan and the anticipated benefits of the Company's business plan, negotiations with potential funding partners and the ability of the Company to secure additional funding, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: AmeriTrust Financial Technologies Inc.

View the original press release on ACCESS Newswire

D.Sawyer--AMWN